The Bank of England raised interest rates for the first time in a decade at the end of last week, reversing the 25bps cut that followed the 2016 Brexit referendum. The cut was largely expected by markets as inflation in the UK has been accelerating but the Bank stressed that any further tightening would be gradual and that inflation would begin to move back to the 2% target once exchange rate dynamcis fall out of the calculation. Markets are largely discounting any follow up hike in 2018 and both sterling and gilt yields fell in response to the slow expected pace of interest rate normalization.

US President Donald Trump nominated Fed governor Jerome Powell to be the next chair of the Federal Reserve. Powell’s nomination was expected by the market and he is seen as the continuity candidate and is expected to maintain current chair Janet Yellen’s gradual approach to policy tightening in 2018. Markets continue to price in a rate hike at the Fed’s December meeting and at least one more 25bps raise in 2018. Beyond managing the outlook for rates Powell will need to manage a newly constituted Fed Board following several departures. This may make it less easy for him to simply execute the policies of his predecessor, and could create challenges that are unexpected.

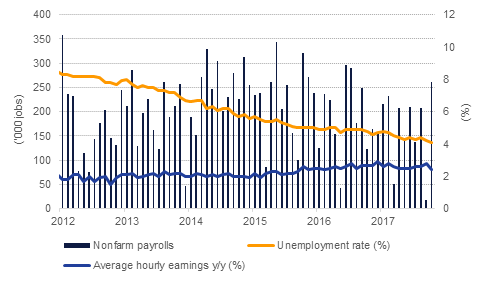

The US added 261k jobs in October and September’s payroll figures were revised from a decline of 18k jobs to growth of 33k. A large jobs number was expect as regions of the US affected by hurricanes in September recovered but the revision to prior data shows the impact was less severed than had initially been estimated. The unemployment rate also moved lower and has settled at a 17-year low of 4.1%. However, a decline in the labour force was a catalyst in helping the unemployment rate extend its decline. Average hourly earnings moved lower, growing by 2.4% in October from 2.8% a month earlier. The backward movement in wages does raise questions over how tight the labour market in the US really is.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Sovereign yield curves flattened during the week in response to nomination of centric Jerome Powell as the next Fed Chair amidst solid economic data supporting the rate hikes in the immediate future. Yields on 2yr UST climbed 4bps to 1.61% while those on 10yr and 30yr declined to 2.33% (-4bps w/w) and 2.81% (-7 bps w/w) respectively during the week. Curve flattening was also the trend in the European sovereign space with yields on 10yr Gilts and Bunds closing the week lower at 1.26% (-7bps) and 0.36% (-0.4bps).

Boosted by higher oil prices, GCC bonds outperformed their global counterparts on credit spread basis. Option adjusted spreads on Barclays GCC index widened only a bp to 132bps during the week while that on US IG bonds increased 2bps to 99bps and on EM IG bonds widened 3bps to 144bps. CDS levels on GCC sovereigns were largely stable barring that on Bahrain which widened 25bps tio 265bps after reprts surfaced abouit Bahrain asking its neighbours for financial support.

Arrest of several high profile members on corruption charges in Saudi Arabia will likely keep sentiment soft on Saudi bonds in the coming days which otherwise have remained well supported after affirmation of it’s A+/stable rating by Fitch late last week.

Fitch also affirmed Bahrain’s rating at BB+ with a negative outlook.

AUD underperformed on Friday, losing ground against the other major currencies. The buck found itself under pressure after softer than expected economic data showed that retail sales remained flat in September 2017, disappointing market expectations for 0.4% m/m growth following the previous months 0.5% contraction. As we go to print AUDUSD trades at 0.7655, remaining below the 200 day moving average (0.7698) it broke and closed below at the end of last week. While the price continues to trade below this level the risks are a retest of the 50% one year Fibonacci retracement (0.7643). A break of this level is likely to catalyze a further decline towards 0.7529, the 38.2% one year Fibonacci retracement.

Political developments in the region dominated trading as uncertainty remained over the impact. The Tadawul recouped early session losses to close +0.3%. It is likely that buying from government funds supported the broader index. However, all other major indices closed in the red with the DFM index and the EGX 30 index losing -1.0% each.

Kingdom Holdings led the decline with losses of -7.6% even as banking sector stocks remained firm. National Commercial Bank gained +0.9%. Elsewhere, real estate sector stocks led the sell-off with Emaar Properties losing -1.4% and Talaat Mostafa dropping -4.3%.

Oil futures rallied the fourth week in a row. Brent gained 2.7% on the week to close above USD 62/b while WTI added more than 3.2% to end the week not far off USD 56/b. The US drilling rig count fell by 8 rigs last week, helping to give some more legs to the current rally while an announcement from a militant group in Nigeria that it has suspended a ceasefire with the government raises risks to supply from the West African nation.

Investors continued to pile into long positions in both WTI and Brent derivatives. Long Brent positions now outnumber shorts by more than 10 to 1, the widest margin since January 2017. Meanwhile the increase in long WTI positions—63k lots in both NYMEX and ICE contracts—was the largest increase since December 2016.

Market structures reinforced the tightening story with WTI time spreads bringing the backwardation closer to the front of the curve. Brent’s 1-2 month spread closed the week a little below USD 0.30/b while the contango in WTI is holding at USD 0.2/b. The 2018 calendar strip for WTI broke through USD 52/b at the end of the week, its highest level since April while the Brent strip has now moved higher than USD 60/b.