Eurozone retail sales disappointed in May, falling to 1.4% y/y from the previous month’s 1.6% - itself a downward revision from 1.7%. Expectations for the May reading were 1.6%. One likely driver of the slower growth is a rise in petrol prices diminishing households’ spending power. With falling unemployment – 8.4% in May, compared to 9.2% a year earlier – and rising wages, retail sales are expected to pick up hereon in. US factory orders expanded 0.4% m/m in May, compared to expectations of 0.0%, and April’s -0.4% (revised from -0.8%). On a y/y basis growth was 8.7%. These figures point to a stronger manufacturing sector, although it should be noted that spending on core capital goods, an indicator of future investment plans, expanded by a weaker 0.3%.

Turkish CPI inflation climbed to 15.4% y/y in June, compared to 12.2% the previous month, owing largely to the dramatic sell-off in the lira and compounded by higher global oil prices. This was the highest level since 2003 and exceeded analyst expectations of 13.9% by some margin. Month-on-month inflation hit 2.6%, while PPI inflation rose from 20.2% to 23.7%, implying that CPI inflation will remain elevated for some months yet.

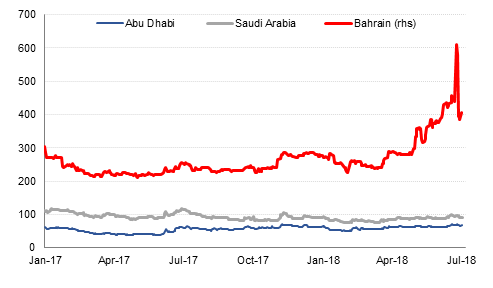

Bahrain’s net foreign assets at the central bank declined by nearly USD 300mn in April, reaching USD 1.78bn, less than 6 weeks’ worth of imports. Markets have become increasingly concerned about Bahrain’s fiscal and external deficit, with low levels of FX reserves underscoring the vulnerability of the pegged exchange rate. Last week Saudi Arabia, the UAE and Kuwait announced that they were working with Bahrain on a support package. The news provided some comfort to investors, although CDS spread remains elevated. Last night it was reported that the country had hired investment bank Lazard Ltd to advise on its fiscal reforms.

The IMF has completed its third review of Egypt’s reform programme, meaning that the country can draw on the next USD 2.0bn tranche of its funding. The Fund praised the progress made on stimulating growth and curbing inflation and unemployment, in addition to the healthy build-up in foreign exchange reserves.

Treasuries closed higher amid weakness in US stocks and ahead of a holiday in the US on Wednesday. Yields on the 2y UST, 5y UST and 10y UST closed at 2.52% (-2 bps), 2.72% (-3 bps) and 2.83% (-4 bps).

Regional bonds continued to trade in a very tight range with the YTW on the Bloomberg Barclays GCC Credit and High Yield index closing at 4.59% (flat) and credit spreads widening 3 bps to 192 bps.

In a series of rating action, Fitch affirmed ratings of Commercial International Bank (BBB+), Rak Bank (BBB+), Noor Bank (A-) and Bank of Sharjah (BBB+) with stable outlook on all.

The Chinese yuan has stabilised overnight, with apparent intervention by the PBOC through state-owned banks. However, concern about escalating trade disputes with the US continue to weigh on markets.

Developed market equities closed mixed amid weakness in technology shares. Continued strength in oil prices did provide some support to broader equities. The S&P 500 index dropped -0.5% while the Euro Stoxx 600 index added +0.8%.

Regional equities closed mixed with the DFM index adding +0.3% and the Tadawul losing -0.5%. Drake & Scull closed limit down as pressure from margin call selling continued. Elsewhere, banking sector stocks in Saudi closed lower with NCB losing -2.0% and Samba dropping -1.4%.

Oil prices gained, with Brent futures climbing 0.4% to USD 78.06/b while WTI jumped 0.6% to USD 74.6/b as US crude volumes reportedly fell 4.51mn b last week. The Saudi Arabian cabinet yesterday ‘affirmed the Kingdom’s readiness to use its spare capacity when needed to deal with any future changes in oil supply and demand rates, in coordination with other producing countries.’

Click here to Download Full article