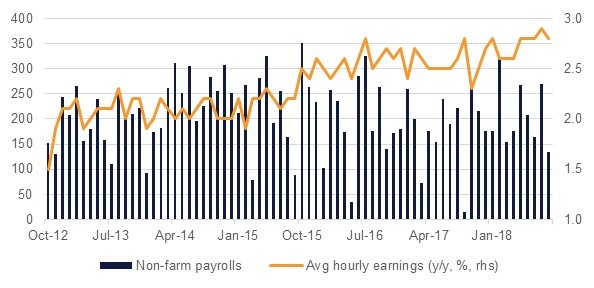

The non-farm payrolls data came in weaker than expected at 134k for September 2018. The weakness can be attributed to hit from Hurricane Florence. However, other aspects of the data which showed unemployment rate dropping to 3.7% from 3.9%, upwards revisions of 87k to previous month data and 0.3% m/m gain in average hourly earnings lends credence to our view that the Federal Reserve will continue to gradually raise interest rates.

Bahrain has signed a deal with Saudi Arabia, the UAE and Kuwait for USD 10bn in financial aid to help bring Bahrain’s budget into balance by 2022. The “Fiscal Balance Programme” aims to achieve BHD 800mn in savings per year over the next five years through a number of reforms including a voluntary retirement scheme for government employees, boosting non-oil revenues, balancing the budget of the electricity & water authority and improving the efficiency of public spending. Steps will also be taken to streamline processes and strengthen accountability within government departments. New procurement and debt management units will be set up within the Finance Ministry as part of the plan. Late last week, Saudi Arabia, the UAE and Kuwait also signed agreements for USD 2.5bn in financial assistance to Jordan, which had been announced in June.

Separately, Saudi Crown Prince Mohammad bin Salman reiterated the Kingdom’s commitment to economic and social reform in a wide-ranging interview with Bloomberg over the weekend. He reiterated the Kingdom’s commitment to an IPO of Aramco, possibly in 2021 after its purchase of SABIC was complete. The Crown Prince noted that around 20 entities were being prepared for privatisation across various sectors, including water, energy, agriculture and sport in 2019. He also alluded to a significant announcement on non-oil investment at the Future Investment conference which is to be held in a fortnight.

In a surprise move, the Reserve Bank of India kept interest rates on hold. However, the central bank changed its stance from neutral to calibrated tightening to indicate that rates will continue to move higher if inflation surprises on the upside. The committee rationalized the decision to soft headline inflation reading even as it cited upside risks to inflation from fiscal slippage, high oil prices and increase in support prices. We retain our view that the RBI will raise rates by 50 bps in FY 2019.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower following strong economic data and comments from Fed Chair Jerome Powell that the Fed may raise rates to levels beyond neutral rate. While the headline non-farm payrolls data was below consensus data, wage growth and positive revisions to previous month data dragged USTs lower. The curve steepened with yields on the 2y UST, 5y UST and 10y UST closing at 2.88% (+7 bps w-o-w), 3.06% (+11 bps w-o-w) and 3.23% (+17 bps w-o-w) respectively.

Regional bonds drifted lower. However, losses were capped following sustained gain in oil prices and flows on account of inclusion of regional bonds into the JP Morgan EMBI index. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +11 bps w-o-w to 4.54% and credit spreads tightened 2 bps to 152 bps.

Bahrain 5y CDS dropped 22 bps w-o-w to close below 300 bps at 284 bps. The decline follows an assistance of USD 10bn to Bahrain by Saudi Arabia, Kuwait and the UAE.

GEMS Education in a statement said that the company will fully redeem all of the outstanding USD 200mn of certificates on the first call date of 21 November 2018. The redemption will include outstanding face amount of the certificates together with any accrued and unpaid profit.

The EURUSD fell 0.71% last week, to close at 1.1522 on Friday. Of technical significance is over the course of the week, the price broke below the 100-week moving average (1.1502) but did not close below this key level. The risk in the week ahead is that a break and a close below this level can catalyze more significant losses towards the August 2018 lows of 1.1301. On the other hand, should this level continue to hold and act as a support, we can expect a retest of the 50-day moving average (1.1597, also the 23.6% one-year Fibonacci retracement). A break and daily close above these levels could be the primers for a longer rebound.

In contrast to its European neighbour, the pound outperformed last week, gaining on all of the other major currencies. During this period, GBPUSD was able to rise by 0.67%, closing at 1.3118 in a move that saw the cross finding support at the 50-day moving average (1.2973) and closing just above the 100-day moving average (1.3111) and 100-week moving average (1.3104). This final development is noteworthy as the 100-week moving average had false break outs the previous three weeks, and this fourth break is the only one that has been sustained. This paves the way for further gains towards the 38.2% one-year Fibonacci retracement (1.3317), which is likely to be the path of least resistance while the daily closes remain above the 23.6% one-year Fibonacci retracement (1.3067).

Regional equities closed lower amid weak global cues. The Tadawul and the Qatar Exchange lost

-1.3% and -0.6%. Drake & Scull gained +2.9% as shareholders voted to continue operations. The Tadawul was led lower by weakness in petchem stocks with Kayan dropping -4.2%.

Oil markets added to their gains last week, rallying five weeks in a row for both Brent and WTI futures. Prices have come off to start the week on news that the US may offer some waivers to its Iran sanctions to countries that are making an effort to cut down on Iranian imports while a wide ranging interview with Saudi Arabia’s crown prince, Mohammed bin Salman, indicated that Saudi had or would replace the dropoff in Iranian barrels.

The drilling rig count in the US fell again last week, its third consecutive week in a row of declines while the investor outlook on both WTI and Brent slipped last week. Net length in both contracts declined as both benchmarks’ recent highs likely prompted some profit-taking.