The UAE, Saudi Arabia, and Kuwait have said that they are in talks to support Bahrain’s economic reforms and fiscal stability and will soon announce an integrated program according to a statement sent to newswires. The news came following another day of pressure on Bahrain’s markets where the five-year credit default swap touched 609bps yesterday, its highest level on record since the financial crisis. Yesterday the Central bank of Bahrain also reiterated its commitment to ‘the existing monetary policy, centered on a peg to the USD’ but markets remained sceptical given that FX reserves amount to only USD2.1bn equivalent to approximately six weeks of import cover.

The promise of financial support will be welcome given the doubts about Bahrain’s long term debt sustainability. Excluding the ongoing budget deficits (expected at around -8.5% of GDP this year), Bahrain will need circa $10 billion over the next two years for debt servicing and repayment alone. The latest market sell off had no particular catalyst with not much having changed about Bahrain’s economic fundamentals in the last few weeks, but pressure has been building for a few months now causing policymakers to finally react, which has seen the CDS spread fall back below 600bps overnight.

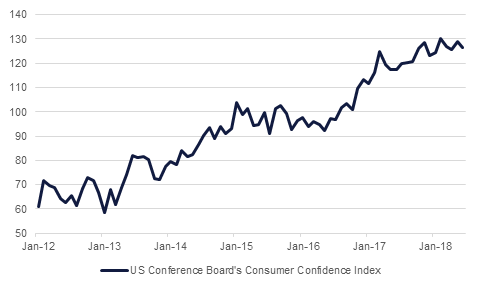

Economic data overnight saw the US Conference Board’s consumer confidence measure slip back 126.4 in June from 128.8 in May. Over the past year there has been a series of new highs for the index, and the February reading (130) was a 17-year high. US durable goods orders will be the main economic release today but in reality the focus will likely remain on trade tensions which are continuing to determine risk appetite. Interesting comments were heard yesterday from the Dallas Fed’s head Robert Kaplan who said that he expects 2.75% GDP growth for this year partly due to the recent tax cuts, but expects growth to slow next year.

US treasuries were range bound despite escalating trade tensions. Yields on 2yr, 10yr and 30yr USTs closed largely unchanged at 2.53%, 2.88% and 3.02% respectively, notwithstanding the large US$34bn two-year note auction. Across the Atlantic, yield on European government bonds were slightly higher for core as well as periphery countries. Yield on 10yr Gilts also increased by a bp to 1.30%. Credit spreads reflected mixed performance with CDS spreads on Euro Main continuing to widen, closing a bp wider at 75bps, however, CDS spread on US IG index tightened a bp to 66bps level.

GCC bonds remained in sync with global macro events and closed almost unchanged. Yield and option adjusted spreads on Bloomberg Barclays GCC index were stable at 4.68% and 199bps respectively. The key overnight news was the report that Saudi, UAE and Kuwait are working on a support package for Bahrain. Credit curve and CDS on Bahrain bonds that had been widening in recent weeks, gained some relief with 5yr CDS tightening 30bps to 580bps.

ACWA Power is considering raising funds via an IPO to help feed its growing need for cash in order to develop $6 billion to $8 billion a year of electricity generation plant. INTWT 39s have remained well supported this year with yield widening only 30bps to 6.25% from 5.95% last year compared with 115bps widening in the yield on wider Barclays GCC bond index to 4.69% during the same period.

The dollar is steadier against G10 currencies, having improved slightly against the JPY following comments from US trade negotiators yesterday seeking to downplay the threat of restrictions on Chinese investments into US markets. The CNY has also pulled back below 6.60 overnight but remains in the spotlight, having lost a further 0.5% yesterday, with markets questioning whether the Chinese authorities are using the currency as a weapon in its trade stand-off with the US. Elsewhere the NZD dropped to a 2018 low of 0.6812 after the ANZ Business confidence index showed a worsening economic outlook.

Global equities continued to gyrate as investors await more clarity on trade issues. Equity bourses were mixed with Euro Stoxx 50 and DAX closing marginally weaker while FTSE 100 and S&P 500 gained circa 0.37% and 0.22% respectively. This morning equities in Asia are trading mostly in red. Hang Seng is down -0.52% and Nikkei is trailing softer by -0.26% in early morning trades.

Regional markets had a sell bias. DFM was down by 1.11% mainly as a result of 10% fall in DSI, though ADX closed up by 0.63%. Despite the positive sentiment after being included in the MSCI index, Tadawul was down by 0.54% yesterday.

Oil prices surged overnight as markets price in the disruption to Iranian supplies in the coming months. Brent futures gained more than 2% to close at USD 76.31/b while WTI jumped 3.6% to close above USD 70/b for the first time since the end of May. The gains in WTI have more to do with supply outages in Canada than issues around Iranian volume but are nevertheless compressing the Brent/WTI spread to below USD 6/b. Market rumours also indicate that Saudi Arabia is planning to increase crude production to as much as 11m b/d in July, its highest ever level, as it tries to offset declining OPEC production elsewhere.

WTI time spreads have continued to widen on the back of the Canadian supply issues with 1-2 month spread at nearly USD 1.5/b. Dec spreads for WTI have also moved higher, above USD 4/b.

Click here to Download Full article