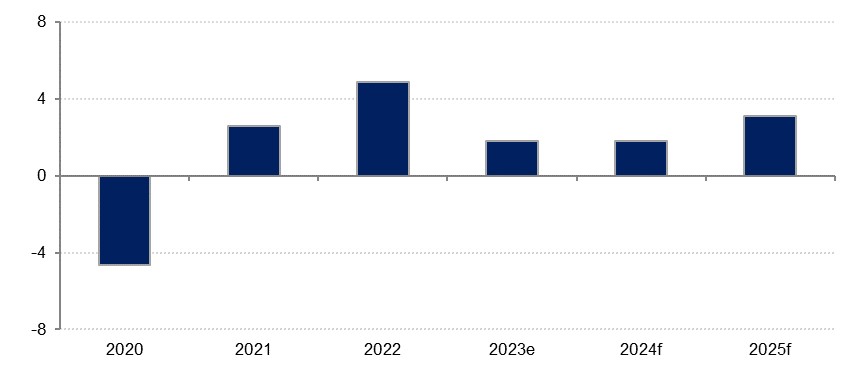

We forecast real GDP growth of 1.8% in Bahrain this year, which if realised would put it in line with our estimate for last year and make it the second-strongest growth in the GCC in 2024, after the UAE. This relative outperformance is in large part down to the fact that Bahrain’s oil sector, at less than a fifth of total output, is the smallest proportional share in the bloc, and, once again, it will be the oil sector which will weigh on the regional growth outlook, with the ongoing OPEC+ production curbs set to see a second consecutive year of lower oil output. In 2025, we forecast an acceleration in Bahrain’s headline real GDP growth to 3.1%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Oil production curbs will weigh on growth

As mentioned, we anticipate another lacklustre year for Bahrain’s hydrocarbons sector amid ongoing OPEC+ limits on production, with OPEC+ members including Bahrain having reaffirmed in October their commitment to the policy. This will likely see constrained output through the first quarter at least, and our production forecast for this year sees no change in production following an estimated 0.5% decline in 2023 (oil production in Bahrain averaged 142,700 b/d over the first nine months of the year, down 4.7% y/y). Bahrain’s Q3 2023 growth note stated that oil production at the Abu Sa’afa field in that quarter was down 10.0% y/y, with the onshore field seeing a drop of 1.7%. While there was a 6.4% y/y increase in natural gas production in the period, hydrocarbons GDP contracted 6.8% y/y nonetheless. Our estimate for oil GDP in 2023 is a 3.0% contraction, and we forecast a further 2.0% drop this year, before returning to growth at 2.0% in 2025.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

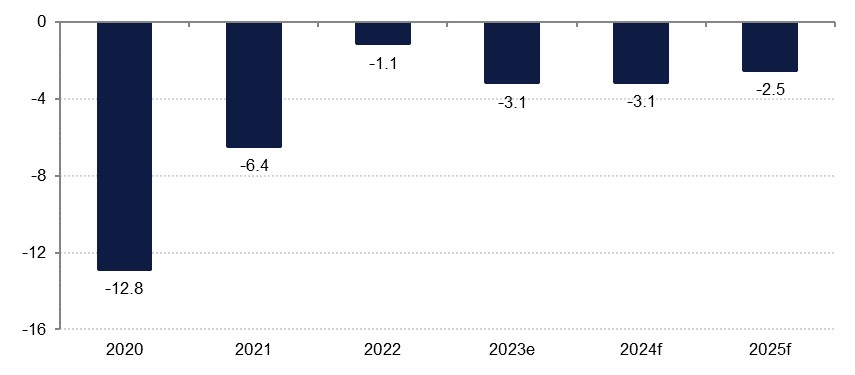

Crucially, this has implications for the budget given that oil and gas exports have traditionally accounted for the vast bulk of government revenues (an average 81% over the decade to pre-pandemic 2019). This has fallen to just over two thirds over 2021 to 2022, and last year we estimate that it shrank even further, to 62.6%, as both oil prices and production fell. This is in part due to a robust expansion in non-oil revenues on the back of diversification of income efforts – VAT now sits at 10% and a 2% tax on expat remittances has been approved by parliament, though is unlikely to be passed by the government. However, the falling oil revenues outweigh this and we estimate that the budget deficit widened to -3.1% of GDP last year, from -1.1% in 2022. This year we expect that it will remain at the -3.1% level before narrowing to -2.5% in 2025. In October, ratings agency S&P revised its Bahrain outlook down from ‘positive’ to ‘stable’ as it estimated that the 2023 deficit would be wider than it had previously anticipated at 3-4% of GDP compared with 2-3% previously.

High interest rates will weigh on non-oil sector

With the hydrocarbons sector under pressure it will be up to the non-oil sector to drive growth once again this year, and we forecast an expansion of 2.7% in 2024, down moderately from the 3.0% we estimate for last year; non-oil GDP growth averaged 3.1% y/y over the first three quarters of 2023 and we estimate a moderate slowdown in Q4 on the back of base effects. While slower than the 4.5% registered in 2022, our estimate for last year would be broadly in line with the long-run average. In 2025 we forecast an acceleration to 3.5%.

Looking ahead, many of the factors that will have determined growth in 2023 are set to remain in play this year, not least elevated interest rates as we do not expect any rate cuts to start until the middle of the year, and to be fairly hesitant even when they do. This will likely constrain private consumption and could drive a slowdown in real estate activity. The impact of higher interest rates on consumption would have been mitigated to a degree by price stability last year, with CPI averaging just 0.1% y/y, but we forecast a moderate acceleration in price growth to 1.0% in 2024.

In terms of individual sectors, the travel and tourism sector has been a notable growth driver of late as it averaged y/y growth of 7.7% over the first three quarters, with visitor numbers up 7.0% y/y in Q3. There were 5.9mn visitors in the first half of the year, putting Bahrain on track to beat its 2018 record of 12.1mn visitors over the year. However, with reopening gains now realised this growth will likely slow materially in 2024. The largest sector in Bahrain’s non-oil economy remains the financial corporations sector, which registered growth of 8.4% y/y in Q3.