.jpg?h=457&w=800&la=en&hash=4A047EE0F34BC619DB72A5D85888A1F2)

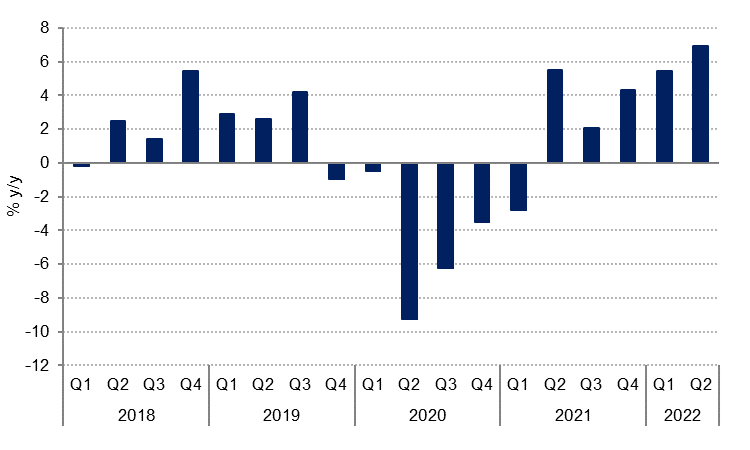

Bahrain’s GDP growth accelerated to 6.9% y/y in Q2 from 5.4% in Q1, even off last year’s high annual base. The oil and gas sector posted strong q/q growth of 10.5% (not seasonally adjusted) but on an annual basis the sector contracted by -2.0% y/y. We expect this to turn positive in H2 2022.

On the non-oil GDP side, transport & communications posted double digit annual growth for the fifth consecutive quarter, up 15.1% y/y in Q2. Manufacturing and government services grew 7.6% y/y and 7.1% y/y respectively, contributing to overall non-oil sector growth of 9.1% y/y in Q2. Bahrain’s largest non-oil sector, financial services, posted more modest growth of 3.6% y/y, up from 3.1% in Q1. The hospitality sectors also saw strong growth of 18.1% y/y in Q2 as it continued to rebound from the pandemic, but is a relatively small contributor to overall GDP.

Given the strong non-oil growth recorded in H1 we have revised up our forecast for Bahrain’s GDP this year to 4.1% from 3.4% previously. We have revised our 2023 forecast down to 3.2% from 3.7% previously.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Inflation has accelerated in recent months, topping 4% y/y in August from 3.9% in July and 3.1% at the start of the year. Food price inflation reached 10% y/y in August, while prices at restaurants and hotels have surged to 15% y/y. Transport costs have also increased this year, up 6.5% y/y in August. However, housing costs – the biggest component of the consumer basket – have declined on an annual basis and clothing & footwear prices have also fallen sharply, at -8.9% y/y in August. We expect inflation to average 3.5% this year, slowing to 2.5% in 2023.