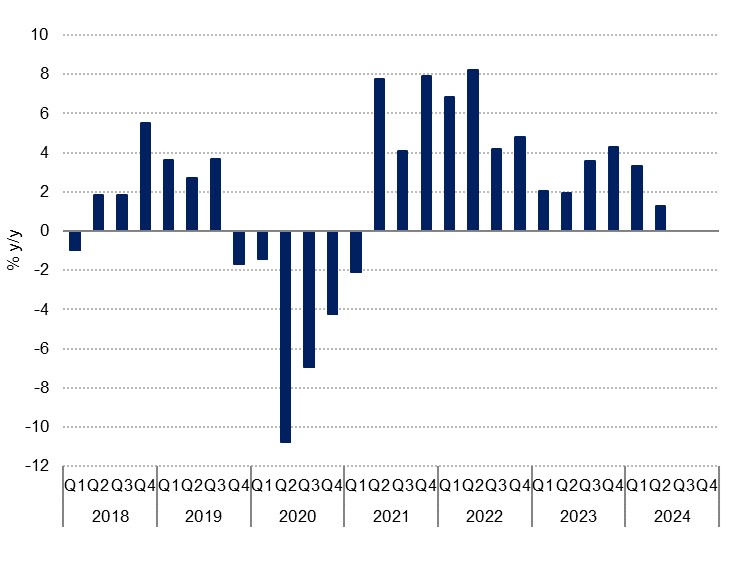

Bahrain logged real GDP growth of 1.3% y/y in the second quarter, marking a slowdown from the 3.3% registered in Q1. That means that H1 saw y/y growth of 2.3%. On a quarterly basis, Q2 expanded 2.2%, compared with a 4.0% q/q contraction in the first quarter. We are holding to our annual growth forecasts of 2.4% this year, and 3.3% in 2025, which would make Bahrain's the second-strongest growth in the GCC in 2024, after the UAE. This reflects the smaller proportion of the oil economy compared with most of the region (less than a fifth of Bahrain’s output over the past decade). As more oil production is expected to come back online in the GCC next year, both the UAE and Saudi Arabia will outpace Bahrain according to our forecasts, but Bahrain should also benefit from a pick-up in hydrocarbons activity.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Oil production heading higher

The hydrocarbons component of Bahrain’s GDP saw a 6.7% y/y contraction in Q2, from 3.4% growth in the first quarter, meaning a H1 contraction of 2.1%. Production at the Abu Sa’afa field was down roughly 4.2% y/y in the first half meaning that total production was down even as the onshore Bahrain field stayed almost flat. Bahrain is not a member of OPEC but is part of the larger OPEC+ grouping that has been controlling supply in an attempt to bid up prices and it has in fact been over-complying with production curbs through the first half of the year. According to the Ministry of Finance press report, Bahrain produced an average of 184,000 b/d in the second quarter across its two primary fields, some way short of its daily production quota of 196,000 b/d.

This over-compliance through the first half offers some upside to Bahrain’s oil GDP through the second half of the year, even as OPEC+ has extended its voluntary additional production cuts through to December. According to the latest OPEC Monthly Oil Market Report, Bahrain produced 182,000 b/d in August, compared with 175,000 b/d through Q2 (this OPEC data is based on secondary sources). Natural gas production also offers some upside to the hydrocarbons sector. As it stands, we forecast a 2.0% contraction in oil GDP this year with some moderate risk to the upside and forecast a return to growth at 2.0% in 2025.

Non-oil sector underpinning growth

With the oil sector set to contract this year, the non-oil sector will drive growth in 2024 and we expect it to remain expansive next year. The second quarter saw real non-oil y/y growth of 2.7%, down from a 3.2% annual expansion in the first quarter. The MoF gives the H1 growth figure at 3.1%. Our forecast for the year is that non-oil growth will hit 3.5%, the same pace as last year, before seeing a modest acceleration to 3.7% in 2025. With the Federal Reserve having embarked on its rate-cutting cycle, starting with a 50bps cut in September, conditions should become more supportive of non-oil activity in Bahrain, especially within the low inflation environment. Price growth has averaged just 1.0% over the year to August, moderating over the past three months in a row.

Similarly to the UAE and KSA, Bahrain’s tourism sector is helping boost non-oil activity. Two of the fastest growing sectors in the second quarter were transportation & storage and accommodation & food services, which expanded 12.9% y/y and 10.6% y/y respectively. Taken together they accounted for 6.7% of GDP. Passengers through Bahrain International Airport were up 15.6% y/y in Q2, while air cargo was up 9.1%. There was a total of 3.7mn tourists in Bahrain over the first half, with overnight visitors up 20.8% y/y and same-day visitors expanding by 17.9%. Development of new resorts should be supportive of growth, even if the post-pandemic pace inevitably slows.

The largest sector in non-oil GDP remains financial & insurance activities, which made up 17.1% of GDP in Q2. Growth in this well-established sector was more modest at 2.1% y/y in Q2, but this followed a 7.4% expansion in the first quarter, and growth over the half was at a robust 4.7%.