Bahrain’s economy contracted -4.6% q/q and -8.9% y/y in Q2 2020. Growth in the hydrocarbons sector helped to mitigate the -10.7% y/y contraction in the non-oil sectors. Hospitality and transport sectors were unsurprisingly the hardest hit, contracting more than 40% q/q due to border closures and lockdown.

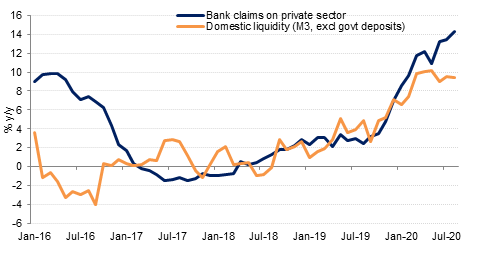

Broad money supply growth in Saudi Arabia slowed slightly to 9.4% y/y in August, while private sector credit growth accelerated further to 14.3% y/y from 13.5% in July. Total public sector borrowing remained strong at 19.7% y/y, slightly faster than in July. Net foreign assets at the central bank rose by USD 5.3bn to USD 448.7bn, the highest level since March. Government deposits at the central bank increased USD 4.6bn last month, likely reflecting higher oil revenues as crude production and prices recovered in August. The value of point of sales (POS) transactions declined -1.2% m/m in August but were still 31% higher y/y. POS transactions rose sharply in May and June as lockdown restrictions were lifted but declined in July when VAT increased to 15%.

The prospect of a new fiscal stimulus support package remains out of reach for now as the first US presidential debate approaches tonight, but reports regarding some moves towards common ground have helped bolster markets in the US. House Speaker Nancy Pelosi has reportedly been meeting Treasury Secretary Steven Mnuchin, with more meetings scheduled, and the House Democrats have unveiled a slimmed-down version of their support package. While at USD 2.2tn it is still far greater than the USD 1.5tn President Donald Trump has said he could accept – and indeed the USD 650bn package proposed by the Republicans previously – it is a tentative step towards common ground. There was further positive news from the US last night, as the Dallas Fed manufacturing index far exceeded expectations, coming in at 13.6 in September compared to consensus 9.5 and up from 8.0 in August.

European economies have looked under significant pressure over the past couple of weeks as the coronavirus pandemic has surged once again in countries such as France and Netherlands, and this has been reflected in the markets. However, comments by ECB President Christine Lagarde yesterday that the bank stood ready to provide further stimulus if it proves necessary has gone some way towards reassuring investors. She acknowledged downside risks, while pledging that the bank stood ready to ‘adjust all of its instruments.’ She declined to comment on the level of the euro however.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

US treasury markets held ground ahead of the US presidential debate scheduled for later today. While the debate is unlikely to mean a knockout punch for either incumbent Donald Trump or Democratic candidate Joe Biden, a shift in polling that shows a stronger lead for one candidate should help to push Treasuries out of their current range. We would expect some form of stimulus to be forthcoming regardless of who wins the election although a Biden victory would likely see support to the economy be larger and help to lift some inflation expectations. Democrats in the House of Representatives have unveiled a new USD 2.2trn support plan, far beyond the proposal from Senate Republicans for a more limited USD 650bn package. Yields on 2yr USTs closed at 0.125% while on the 10yr they settled at 0.6528%.

FAB priced a USD 750mn perpetual at around 4.5% according to press reports. Elsewhere in the region Egypt has mandated banks for the first sovereign green bond issuance from MENA. The Egyptian green bond will have a five year maturity and is likely to be benchmark size.

The RBI has had to reschedule its planned MPC meeting for this week due to an apparent lack of quorum. India’s central bank is in the process of revising its MPC members as three panelists will see their term expire at the end of September. So far no new members have been publicly announced. We had expected the RBI to hold policy steady at this meeting before implementing at 25bps cut at its December meeting.

The USD eroded some its recent gains on Monday. The DXY index retreated from a two-month high reached on Friday, falling by -0.38% after faltering at a resistance line of 94.700 and is now trading at 94.240. USDJPY remains largely unchanged at 105.50.

The EUR recorded modest gains of 0.3% and now trades at 1.1672 following comments from ECB President Christine Lagarde stating that they were ready to deploy more monetary stimulus if necessary. The GBP increased by 0.7% to reach 1.2834, buoyed by cautious optimism about an EU-UK trade deal and comments from BOE Deputy Governor Dave Ramsden dismissing negative rates. Sterling is tentatively extending its gains this morning. It was a volatile session for the NZD, but the currency has consolidated minor gains this morning to reach 0.6565 whilst the AUD is extending Monday’s rally and trades around 0.7080.

Global equities started the week on a positive footing, with noises around some compromises potentially leading to a deal on fiscal support in the US leading the Dow Jones, the S&P 500 and the NASDAQ to post gains of 1.5%, 1.6% and 1.9% respectively. European equities fared even better, with the CAC and the DAX gaining 2.4% and 3.2%, bolstered by ECB President Christine Lagarde’s comments yesterday confirming that the central bank stood ready to provide more stimulus should it prove necessary.

Oil prices managed to close up to start the trading week with Brent gaining 1.2% to settle at USD 42.43/b while WTI closed at USD 40.6/b, up 0.87%. Clashes in the South Caucasus may have added some temporary geopolitical anxiety to oil prices but are unlikely to shift prices sustainably higher.