In the US, the Chicago Fed National Activity Index came in at 0.17 in September. This is above the neutral zero mark that delineates contraction and expansion, but nevertheless was below expectations of 0.21. It was also below the August figure, which was revised significantly upwards yesterday, from 0.18 to 0.27. The three-month moving average stands at a still-solid 0.21, supportive of expectations for another strong real GDP growth print later this week.

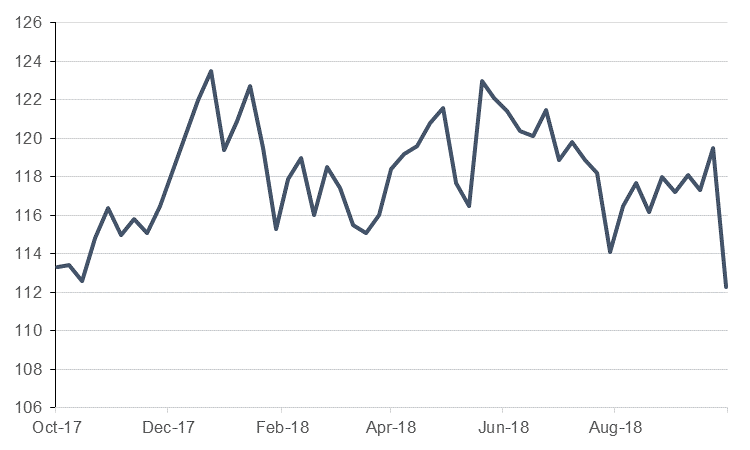

The Australian Roy Morgan Consumer Confidence Weekly fell 6% w/w to 112.3 in data released yesterday, the lowest level for the index in over 12 months and just below the long-term average. The decline was felt across all components of the measure, with household perceptions of current financial conditions down 7.1%, while the ‘time to buy a household’ component fell 7.8%. A number of factors likely contributed to the decline including higher petrol prices and political uncertainty following the Liberal party’s shock by-election loss of Wentworth.

Bloomberg reported that Egypt is considering issuing local currency-denominated bonds on the international market. This follows earlier reports regarding the planned issuance of panda and samurai bonds over the coming quarters. Having been frustrated by persistently high yield demands on its local debt issuances, and falling demand for the securities in general as EM aversion rose, Egypt is turning to other avenues in order to support FX inflows and cut debt servicing costs.

Meanwhile, Moroccan inflation fell to 1.1% in September, from 1.7% in August. The High Planning Commission attributed the slowdown to weaker food price inflation, which fell from 1.1% to 0.6% in September.

Treasuries closed marginally higher as risk assets declined. Yields on the 2y UST, 5y UST and 10y UST closed at 2.90% (flat), 3.04% (flat), 3.19% (+1 bp) respectively.

Regional bonds started the week on a positive note. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -1 bp to 4.64% and credit spreads tightened slightly to 164 bps.

The pound was Monday’s worst performing G10 currency, GBPUSD falling to a six-week low amid reports from the Telegraph that the DUP would support amendments made by Eurosceptics in the Conservative party on Wednesday. Further pressure was piled on by reports from Sky that an unnamed Tory “centrist” was sending a letter of no confidence in Theresa May to committee chairman Graham Brady. As a result of this news, investors sold the pound despite Prime Minister May insisting in front of Parliament that a deal with the European Union was 95% done and winning the support of senior Brexiteers such as Ian Duncan Smith.

Over the course of the day, GBPUSD fell by 0.86% to close at 1.2963 in a move that took the price back below the 50-day moving average (1.3014). In the days ahead, the markets will awaiting May’s performance at the 1922 meeting on Wednesday with the risk that she is getting closer to a leadership challenge.

Developed market equities closed lower as investor’s continued to remain cautious. The S&P 500 index and the Euro Stoxx 600 index dropped -0.4% each.

Most regional equity markets closed higher. The DFM index and the Qatar Exchange added +0.4% and +1.2% respectively. ADIB reported net income of AED 590mn, beating consensus estimates of AED 541.5mn.

Oil markets were broadly stable to begin the week with few fundamental catalysts to shift the market. Brent futures closed at USD 79.83/b while WTI held nearly flat at USD 69.17/b. Saudi Arabia’s energy minister, Khalid al Falih, said the Kingdom had no intention of using its oil production as a tool to influence foreign nations’ policy, as they attempted to in 1973. Falih also indicated that OPEC was open to a long-lasting and more formal relationship with its non-OPEC partners which may imply an even strong relationship between Saudi Arabia and Russia on oil policy. The front end of the WTI curve remains in a shallow contango while Brent time spreads hold their backwardation.