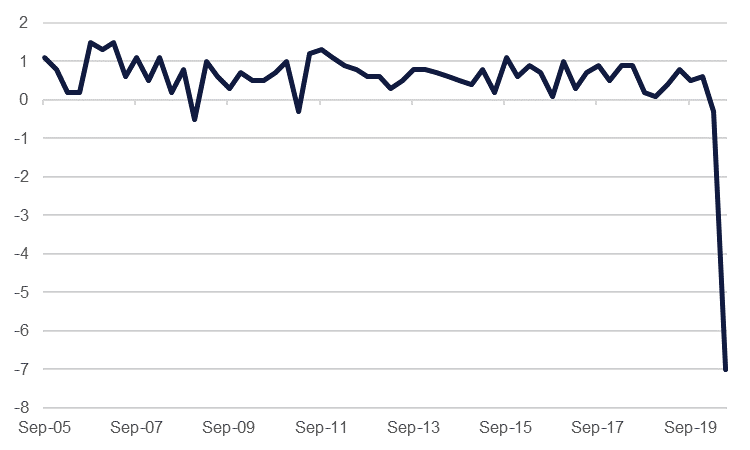

Australia recorded a second consecutive quarter of economic contraction in Q2, confirming that the country has entered its first recession in 29 years. The economy has been on a remarkable growth run over the past three decades, tied in part to China’s expansion, but the coronavirus lockdown resulted in a -7.0% q/q contraction, following the -0.3% seen in Q1. The contraction was -6.3% y/y, and while this compares favourably to other developed markets, it was the worst on record and missed expectations of -5.1%. Brazil also released its Q2 figures yesterday, recording a contraction of -9.7% q/q and -11.4% y/y.

Global manufacturing PMI surveys released yesterday were broadly positive, but their sub-components still held cause for concern with regards to the underlying strength of the nascent recovery, which continues to be jobless for the time being. The JP Morgan global manufacturing survey exceeded 50.0 for the second month in a row, rising to 51.8 in August. In Europe, the Eurozone manufacturing PMI was flat on the previous month at 51.7, while the UK dipped modestly from 55.3 in March to 55.2 and Japan rose from 46.6 to 47.2. However, in the UK for instance, job losses were recorded in the survey for the seventh month in a row.

In the US, the ISM manufacturing survey hit 56.0, up from 54.2 in July. This was the fastest pace of expansion since 2018, with new orders a particular bright spot as the sector recovers from the lockdown. However, here also jobs continue to be cut, and while the employment sub-index was at a six-month high, it remained in contractionary sub-50.0 territory at 46.4. The US Markit PMI survey fell modestly from 53.6 to 53.1.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasury yields were broadly lower yesterday as US politicians have still not reached consensus on a new coronavirus relief package and in spite of a strong ISM manufacturing print for August. Yields on 2yr USTs were essentially unchanged at 0.1309% but are testing lower this morning while yields on 10yr USTs fell by more than 3bps to 0.6689%.

Local currency EM bonds are tentatively narrowing in on the performance of USD bonds. With the Fed likely to make use of tools that will weaken the dollar and with many EM central banks still having room either to cut nominal rates or introduce their own unconventional policies, performance of local currency debt may start to accelerate over USD-denominated bonds. Yields on India’s 10yr bond have fallen around 25bps since late August as the RBI actively targets the longer-end of the curve with asset purchases.

Fitch downgraded its rating on Bahrain’s Ahli United Bank to ‘BB+’ and placed the outlook on stable. In Kuwait they affirmed the ‘AA-‘ rating on National Bank of Kuwait with a stable outlook.

FX

The dollar rebounded for the first time in time in three sessions on Tuesday evening. The DXY index has continued to rise this morning, earning modest gains to reach 92.370 after touching a fresh two-year low. Similarly the USDJPY pair was little changed throughout the day but has risen back just above the 106 handle.

The euro reached a daily high of 1.2011 in the afternoon but failed to hold onto these gains as the dollar strengthened. The currency recorded moderate losses and has fallen to 1.19. The same can be said for Sterling, reaching a yearly high of 1.3482 only to decline to 1.3370. The AUD has consolidated losses at 0.7350 after a worse than expected contraction in Australian GDP, whilst the NZD advanced by as much as 0.65% to trade at 0.6775.

Equities

It was a particularly bad day for the FTSE 100 yesterday, as a strengthening pound and some inherent weaknesses in the makeup of the index in the current environment (heavy on energy and mining, low on tech) saw it lose -1.7% on the day, and the index is now back at levels last seen in May. By contrast, tech stocks continue to bolster US equities, with the NASDAQ gaining 1.4% yesterday, while the Dow Jones and the S&P 500 both gained 0.8%. Regionally, the DFM closed 0.3% higher yesterday while the Tadawul lost 0.5%.

Commodities

Oil prices closed higher to start the month with Brent futures adding 0.66% to close at USD 45.58/b and WTI up by around 0.4% at USD 42.76/b. Both contracts are pushing higher in early trade today, nudged on by more than 6m bbl draw in US crude stocks reported by the API. Gasoline inventories also fell, by a 5.8m bbl. EIA data is set to be released later today.

OPEC’s August production numbers showed a more modest increase than was expected as both Iraq and Nigeria delivered cuts to make up for failing to hit targets earlier in the year. Total output was up by 550k b/d m/m with production from Saudi Arabia rising by 410k b/d and the UAE up by 200k b/d.