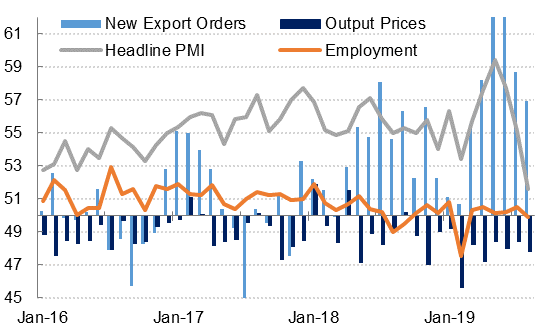

PMI survey data showed a marked slowdown in non-oil sector activity in the UAE in August, with the UAE PMI falling to 51.6 (from a 2019 high of 59.4 in May), while the Dubai PMI declined to 51.7 last month, the lowest reading since February 2016. The softer Q3 PMI readings have been due to slower growth in output and new orders, following a strong performance in Q2.

We have noted that the Q2 PMI data likely reflected sharply higher export orders as well as some boost to household spending over Ramadan (May) and a longer private sector Eid holiday in June.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The weaker Q3 readings reflect domestic fundamentals reasserting themselves in the UAE, as firms discounted prices at the steepest rate in four months, and employment was fractionally below the neutral 50.0 level in August. Inventories declined in August for the first time since January, and this also weighed on the headline PMI reading for the UAE.

In Dubai, the construction sector PMI fell to 50.6 in August, the lowest reading since February 2016 on much slower new orders and output growth. Employment in the sector fell for the fifth month in a row. The wholesale & retail trade sector also posted the lowest PMI reading year-to-date, despite further declines in average selling prices.

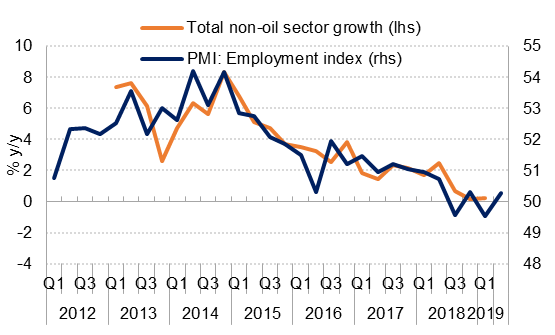

There has been no job growth on average in the UAE’s private sector this year (Chart 1), and no rise in wages either according to the PMI survey data. Official data published by the UAE central bank showed only marginal growth in private sector jobs in H1 2019 and declining average salaries across all job categories. This suggests that household consumption is likely to remain constrained, and puts the onus on government to boost spending and investment in order to drive growth in the non-oil sectors of the economy. Chart 2 below shows the close correlation between private sector employment in the UAE and overall non-oil sector growth, illustrating the importance of household consumption as an engine of economic growth in the UAE.

Source: IHS Markit, FCSA, Emirates NBD Research

Source: IHS Markit, FCSA, Emirates NBD Research

Although the UAE ministry of finance data shows consolidated government spending rose 21.6% y/y in the first quarter of this year, this does not appear to have had an impact on non-oil sector growth in the UAE over the period. Official estimates show non-oil sector growth of just 0.3% y/y in Q1 2019, only fractionally higher than in Q4 2018. The softness in growth appears to be concentrated in Abu Dhabi, with Q1 GDP data showing a contraction of -0.9% y/y in the non-oil sector, the third consecutive quarter of negative annual growth in the emirate.

Unlike the UAE, Saudi Arabia’s PMI has been broadly unchanged over the summer, averaging 57.1 from May - August, with output and new order growth slowing only slightly in July and August. However, even in Saudi Arabia, sustained growth in business activity has not translated into increased private sector employment year-to-date and there is very little pricing power evident on the part of firms. In our view, growth in the non-oil sectors of the economy this year has been underpinned by government spending in the kingdom, which was up 6.3% y/y in H1 2019 and 11% y/y in 2018.