Flash PMI data for August was a mixed bag, with UK and US indices beating expectations while the preliminary data for the Eurozone pointed to a slowdown in the recovery. The Eurozone composite flash PMI declined to 51.6 in August from 54.9 in July, as both manufacturing and services sector activity slowed. The resurgence of coronavirus cases in some Eurozone countries followed by tighter restrictions on some services likely weighed on the August reading.

In contrast, UK and US preliminary PMI data was better than expected in August. The UK composite PMI rose to 60.3 from 57.0 in July. Restaurants and other hospitality businesses benefitted from the lower VAT rate and the government’s “Eat Out to Help Out” incentive scheme. Retail sales (excluding autos and fuel) rose by a bigger than expected 2.0% m/m (3.1% y/y) in July, exceeding pre-pandemic levels, as non-essential shops were open for the full month. It remains to be seen whether the recovery in activity and consumer spending can be sustained once the government’s furlough scheme expires in October.

The US composite PMI rose to 54.7 in August from 50.3 in July as both manufacturing and services sectors gained momentum. Encouragingly, employment in the services sector picked up at the fastest rate since February 2019. Separately, US existing home sales surged almost 25% m/m in July, well above expectations of a 14.7% m/m increase. US equities responded positively to Friday’s better than expected economic data, with the Nasdaq Composite and S&P500 both closing at a record high.

The main event this week is the Kansas City Fed’s Jackson Hole symposium, where Jerome Powell is due to speak on Thursday morning. He is expected to talk about the Fed’s monetary policy framework, which has been under review since last year. It is possible the Fed is considering a shift to an average inflation target, which would imply a greater tolerance for inflation to overshoot 2% for a period of time. This would mean interest rates could stay lower for longer.

Turkey’s central bank left interest rates unchanged as expected on Thursday but raised the required reserves for commercial banks, effectively tightening monetary policy.

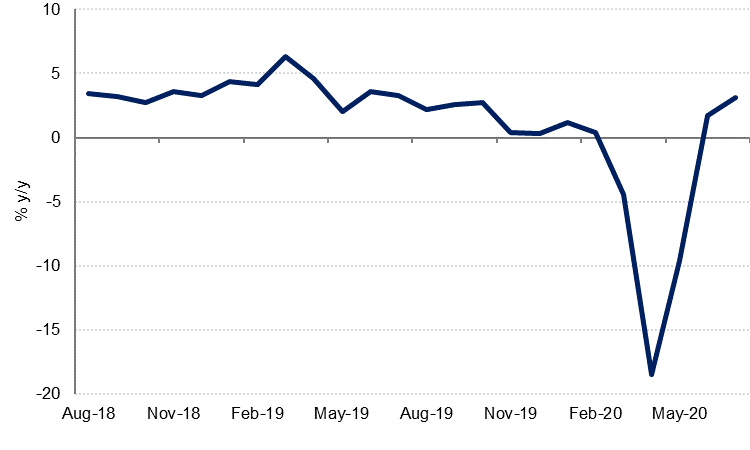

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Dovish Fed minutes and waning chances of new fiscal stimulus in the US weighed against better than expected housing and activity data to help sink UST yields last week. USTs rallied across the board with yields on the 2yr UST down slightly to 0.14% at the end of the week while 10yr yields fell more than 8bps to close below 0.63%.

Focus for bond markets this week will be on the Jackson Hole summit of central bankers with inflation again likely to take the starring role.

Emerging market USD bonds were broadly unchanged last week with a slight downward bias. Spreads over UST did tick back up, however, to 361bps from 355bp a week earlier.

Fitch revised its outlook on Turkey’s sovereign rating to negative at the end of the week, noting the country has depleted its foreign exchange reserves and central bank policy leading to wide negative real interest rates. Fitch rates Turkey at ‘BB-‘.

FX

The euro declined by -0.62% and settled at 1.1796 following disappointing PMI readings for the eurozone and the dollar's modest strengthening. This comes after reaching a two-year high of 1.1958 last Monday, and advancing in the previous eight consecutive weeks.

Sterling was unable to hold onto its gains and finished the week largely unchanged at 1.3090. PMI data out of the UK returned better than expected, with the composite data jumping to a seven year high at 60.3, providing a boost for the pound.

The AUD slipped by -0.73% to close at 0.7161, whilst the NZD declined by -0.27% to settle at 0.6540.

Equities

The S&P 500 gained 0.7% last week for a record close at 3,397, and now stands 5.2% higher than it started the year after recouping all of its pandemic-related losses. Otherwise, local regional equity indices were amongst the strongest performers globally last week, with the UAE’s stocks in particular faring well. The DFM closed 3.7% higher on the week (despite losing 0.5% on Thursday) and the ADSM was up 3.6%, while in Saudi Arabia the Tadawul gained 1.8% over the period.

In Europe however the picture was a little less positive. The major European indices all closed down w/w, with the FTSE 100, the CAC and the DAX losing 1.5%, 1.3% and 1.1% respectively after ceding ground on Friday. While the PMI surveys released at the close of the week were broadly positive, the Eurozone survey missed expectations, and the devil was likely in the detail for investors as the employment components suggested that the recovery would be protracted.

Commodities

Oil markets had a quiet week, ending the session mixed but very much within their recent ranges. Brent futures fell by 1% to close at USD 44.35/b while WTI settled at USD 42.34/b, a gain of 0.8%. Two hurricanes are headed for the US Gulf Coast and production has already been shut in as a response. However, prices have not displayed much reaction yet to the threat posed by the storms.