Although the IMF downgraded its global growth outlook again this month, markets are detecting some tentative signs of improvement on a number of fronts which have allowed the rally in risk appetite to continue. A U.S.-China trade deal would go a long way to cementing this improvement, although possible headwinds on other fronts still remain.

- Global macro: While concerns about the global economy have in some ways got worse in the last few weeks, culminating in the IMF downgrading its forecasts for the world economy, in other ways there have been some tentative grounds for optimism.

- GCC: Preliminary estimates show that the UAE’s GDP growth last year was slower than expected at 1.7%. Our analysis suggests that Abu Dhabi’s non-oil sector was the weak spot in terms of growth.

- MENA macro: The monetary policy of North African oil importers will be relatively conducive for growth this year, as we expect no rate hikes in Egypt, Tunisia or Morocco. The more favourable domestic inflation outlook and less hawkish developed markets should allow Egypt room to resume its tentative easing cycle towards the end of the year, while Tunisia and Morocco will likely remain on hold.

- Interest Rates: Government bonds had another month of solid gains on increasingly dovish policy makers.

- Credit Markets: GCC bonds were well bid on the back of falling benchmark yields and narrowing credit spreads.

- Currencies: G10 currencies have performed better at the expense of the USD as confidence in avoiding a global recession has grown.

- Equities: Over the past month, global equities consolidated their gains further. This was primarily driven by fading of trade related geopolitical risks, initial signs that the growth in China is stabilizing and central banks across economies turning supportive of risk.

- Commodities: Oil prices have soared thanks to production cuts from OPEC+. The trajectory for prices over the rest of the year could largely be determined by critical events in Q2 including US policy on Iran sanctions and whether OPEC+ will keep its cuts in place.

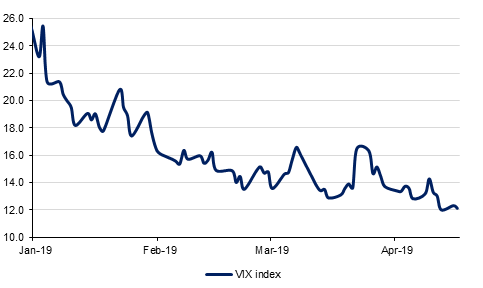

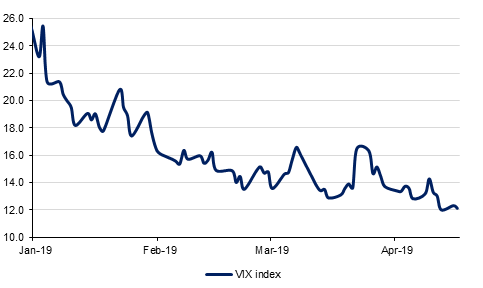

Volatility calms as recession fears recede

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to Download Full article

.jpg?h=457&w=800&la=en&hash=B2C35051AB95E0C8766DC85305AC6A0E)

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research