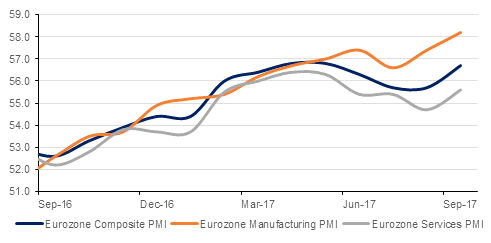

Angela Merkel won a fourth term as German chancellor, however, total support for the two main political parties in the country declined. Both Merkel’s Christian Democrat-led bloc (32.5% of votes) and her main challenger, Martin Schulz’s Social Democrats (20% of votes), reduced to historic lows as votes flowed to the anti-immigration Alternative for Germany, or AfD (13.5% of the votes), in a sign of the growing polarization that is largely driven by differences in approach to the refugees crisis. With continuation of the status quo, impact on financial markets is likely to be contained, particularly as economic data augurs for a sustained recovery in the Eurozone. Euro-area September composite PMI rose to 56.7 vs expectations of 55.6 and vs 55.7 in the prior month. Both manufacturing and services PMI were stronger than the previous month.

Moody's downgraded its credit rating on Great Britain by one notch to Aa2 from Aa1, citing the country's weakening finances and the impact of its decision to exit the European Union. Moody's said it expects Britain to see higher budget deficits as a result of political and social pressure to increase spending after years of cuts. It also sees Brexit eroding the country's economic strength. Elsewhere, Prime Minister, Theresa May emphasised on a two year transitory period after the implementation of Brexit in March 2019 which in turn is likely to help alleviate any material shock to the economy.

Last week’s FOMC statement was slightly more hawkish than what the market was expecting. December rate hike is firmly on the offering though rate hike projections for 2019 and 2020 were revised lower. Balance sheet unwinding will begin next month at $10 billion per month and will only be increased very gradually. Data released late last week reflects the US economy to be on solid footings. Jobless claims have been less than expected and Markit composite PMI came in at 54.6, still in a steady expansionary phase although slightly softer than the previous month’s reading of 55.3.

In the far-east, Japan’s September flash manufacturing PMI rose to 52.6 from 52.2 in August and compares favourably with 50.4 at the same time last year. Looking ahead, the key data releases to watch this week are UK GDP, Core PCE in the US and yearly inflation in Germany.

Source: Emirates NBD Research

Source: Emirates NBD Research

There was little ambiguity in Fed’s statement post the FOMC meeting last week. December rate hike is firmly on the offering and dot plot was revised downwards in the longer run. Consequently UST 2yr 10yr curve flattened with yields on 2yr and 10yr closing at 1.43% (+4bps) and 2.25% (+2bps) during the week. Across the ocean, hawkish tone of BoE officials lead to increased possibility of UK rate hikes materialising sooner than expected. Yields on 10yr Gilts rose 5bps to 1.35% during the week.

In an environment of rising benchmark yields and strengthening dollar, emerging market bonds had little protection. GCC bonds were soft across the board even though oil price maintained firmness at around $55/b. Credit spreads on Barclays GCC bond index widened 2bps to 136bps, taking YTW to 3.32% (+5bps) during the week. The softer tone was exaggerated by thin trading volumes due to the Hjiri New Year holiday in the region.

Local investors’ interest in acquiring bonds of Dubai Aerospace (which were entirely placed in international markets in July this year) remain high. Price of DUBAEES 20s and 21s increased circa quarter of a point during the week to close at yield of 3.29% (-7bps) and 3.88% (-6bps) respectively. Given its ownership by the Dubai government, DUBAEES bonds still look attractive compared with EMIRAT 23s at 3.43% and DUGB 21 at 2.89%.

Sterling underperformed on Friday, softening against all the other majors. The pound came under pressure after Prime Minister May’s Brexit speech proved to be short on details and failed to clarify specific details. Over the course of the day, GBPUSD declined 0.57% to 1.3504, snapping a four week rally. While the pair remains in a daily uptrend at this level, the U.K.'s Ratings Cut to Aa2 from Aa1 by Moody's over the weekend leads to risk of further immediate downside.

It was a mixed start to the week for regional equities. While the DFM index and the ADX index dropped -0.9% and -0.3% respectively, the Qatar Exchange gained +0.4%. In case of Qatari stocks, it appeared to be simply a case of bottom fishing than any change of investor sentiment.

Oil prices ended the week higher on comments from OPEC that inventories globally were drawing and that the impact of supply cuts was finally being felt in the market. Brent futures closed up 2.2% while WTI closed 1.5% higher on the week. Russia’s energy minister played down any imminent announcement that OPEC and its partners would extend their current cut deal beyond the end of March 2018 but wanted that a disorderly exit to the deal would disrupt markets.

Curve structures remained intact with the Brent backwardation widening. December spreads are now hovering near to USD 2/b for Dec 17-19 as the rally in near term prices isn’t being matched along the rest of the curve. WTI Dec spreads have also punched tentatively nearer to backwardation although as the US enters refinery turnaround season we would be cautious how persistent the backwardation will be.

Oil volatility continues to drift lower as the market has been grinding, rather than leaping upward. The independence referendum in the KRG may throw some political noise into markets at the start of the week but its overall impact on global balances will be limited in the near term.