In a sign of her diminishing authority, German Chancellor Angela Merkel is said to be quitting as head of the Christian Democratic Party after almost two decades in charge. This decision has raised questions over her ability to remain as Chancellor despite her intention to serve out her current term which ends in 2021, in effect turning her into a ‘lame duck’. While it is unlikely to impact on Germany’s economic growth it may make decisions within Germany over key structural issues facing the EU more difficult, such as over Italy’s budget and over Brexit. It may also increase the risk that the CDU/SPD coalition could collapse well before the end of its term, with the AFD and Green parties standing to benefit from the current turmoil in the country’s more established parties.

The UK budget speech saw Chancellor Hammond deliver on promises to increase spending and cut taxes thanks to a reduction in the government’s borrowing forecasts and assumptions about stronger growth. The GDP growth forecast was raised to 1.6% for next year from 1.3% previously, with expected borrowing cut by GBP11bn. The budget was clearly designed to assuage critics of the government over the course of very difficult Brexit negotiations, and may even be a marker for a possible election or leadership challenge in coming months. However, should the UK leave the EU without a deal the chances are that some of the budget arithmetic may have to be reworked bringing an ‘end’ to the ‘end of austerity’.

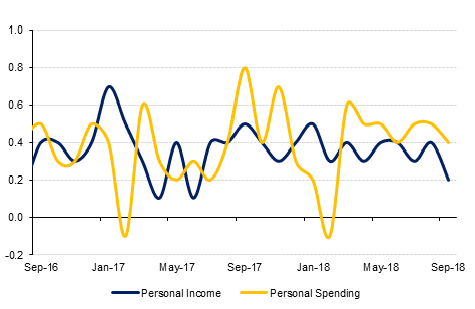

U.S. personal income and spending in September rose by 0.2% and 0.4% respectively, demonstrating that consumption remained firm throughout the quarter as shown by the 4.0% contribution to quarterly GDP. Elsewhere the U.S. Dallas Fed manufacturing index bounced 1.3 points to 29.4 in October after falling 2.8 points to 28.1 in September. Meanwhile reports that the Trump administration is planning more tariffs if the talks with China fail at the end of next month saw U.S. equities give up their attempt at a rally.

Treasuries bear steepened and ended the day off their worst levels as US equities pared early session gains to move into negative territory. Yields on the 2y UST, 5y UST and 10y UST closed at 2.81% (+1 bp), 2.92% (+2 bps) and 3.08% (+1 bp) respectively.

The US Treasury department said that the government borrowing this year will more than double from 2017 to USD 1.34tn as the government finances a rising budget deficit.

Regional bonds traded in a tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index remained flat at 4.61% while credit spreads tightened 1bp to 171 bps.

AUD is this morning’s outperformer, gaining on all the other majors following comments by U.S. President Trump on trade with China. After saying a deal with China would be “great”, risk appetite returned to the market resulting in gains for equity markets and commodity currencies. As we go to print, AUDUSD is trading 0.47% higher at 0.70884. However, despite these gains, the price remains in the daily downtrend that has been in effect since January 2018. In order to break out of this trend, the cross has to realize a daily close above the 50-day moving average (0.7174).

Developed market equities closed mixed with the S&P 500 index losing -0.7% and the Euro Stoxx 600 index adding +0.9%. Weak earnings from technology companies in the US and reports of further escalation in trade war between the US and China weighed on investor sentiment. After the markets closed, Donald Trump talked about a potential deal with China.

Regional equities closed mixed with the DFM index losing -0.4% and the Tadawul adding +0.6%. The Tadawul was led higher by strong corporate earnings across the board. Elsewhere, volumes continued to remain well below 1-month averages.

Renewed anxiety over a trade war between the US and China helped to weaken commodity prices at the start of the week. Brent fell by 0.4% to close at USD 77.34/b while WTI lost more than 0.8% to finish the day just above USD 67/b. Both curves continued to weaken with the Brent forward curve in the first six months flat while the contango in WTI has held roughly steady across the first four months at around USD 0.15/b for each monthly spread.

Click here to Download Full article