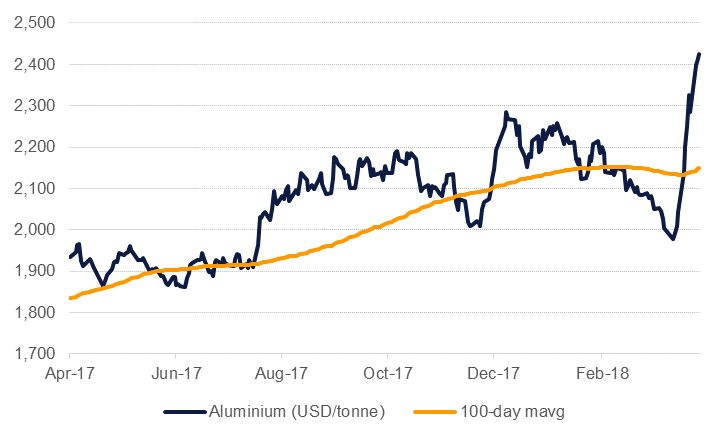

Aluminium prices have spiked in response to the imposition of US sanctions on Rusal, a major Russian producers. LME prices are trading above USD 2,400/tonne, near their highest level since 2011. Russia was the second largest producer globally of the metal in 2017, producing virtually all Russian metal. The company was also a major supplier of metal to the US, accounting for 10% of total imports. Considering the deteriorating political relationship between the US and Russia we see little chance that these sanctions will be lifted in the near term.

Source: Eikon, Emirates NBD Research.

Source: Eikon, Emirates NBD Research.

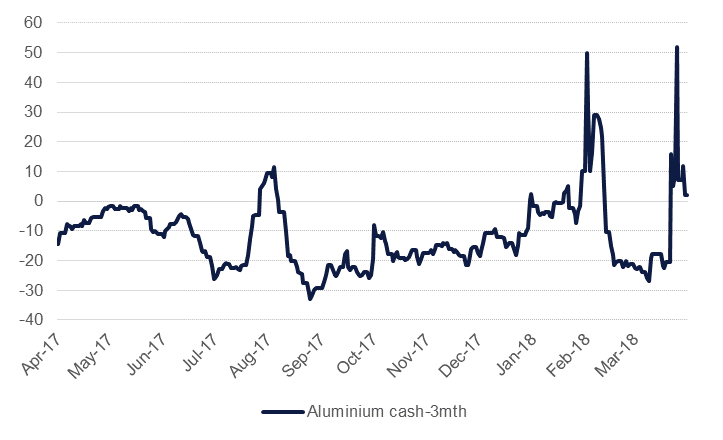

The aluminium forward market has oscillated wildly in recent weeks as it balances the introduction of US tariffs (notionally negative for flat prices) against these new sanctions (notionally supportive for prices). Cash-3mth aluminium on the LME has swung between wide backwardation and contago in response to policy developments. Part of the upswing in prices over the last two weeks is likely to down to short-covering as neither a carry trade or outright position appears sound in the current market.

Source: Eikon, Emirates NBD Research. Note: USD/tonne.

Source: Eikon, Emirates NBD Research. Note: USD/tonne.

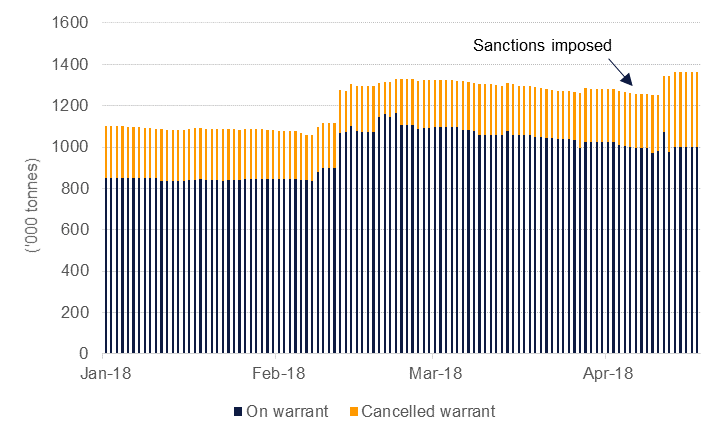

However, the apparent tightness the LME price currently reflects may begin to ebb as the exchange has now halted deliveries of Rusal metal that was produced after the sanctions came into effect. Inventories on the LME rose shortly after teh sanctions came into effect as pre-sanction metal is likely being unloaded onto the exchange. An increase in stocks as a result could push the aluminium forward curve back into contango even if unsanctioned metal becomes relatively scarcer for industrial users.

Source: Eikon, Emirates NBD Research.

Source: Eikon, Emirates NBD Research.

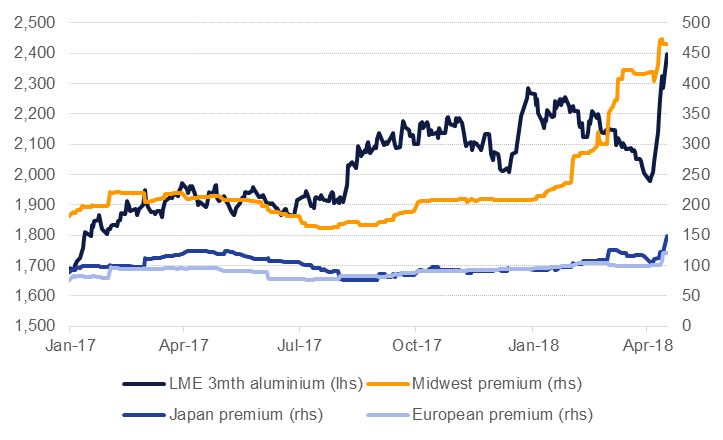

We expect that regional premiums will offer a better picture of relative tight or loose market conditions. Midwest US premiums spiked in relation to the introduction of US tariffs on imported aluminium but Japanese and European premiums have now started to climb in relation to the sanctions on Rusal and have begun to narrow their discount to the US. All-in prices for aluminium in the US have soared to over USD 2,860/tonne, mostly as a result of the increase in Midwest premiums. While Japanese and European premiums have some way to go to catch up with the sharp rise in US levels, factors beyond the sanctions on Rusal may contribute to more tightness in the market.

Source: Eikon, Emirates NBD Research. Note: USD/tonne

Source: Eikon, Emirates NBD Research. Note: USD/tonne

At the same time as the Rusal sanctions are hitting the primary metal market, the aluminium raw material market is tightening thanks to the partial shutdown of a bauxite mine in Brazil owing to investigations into spilling of toxic material into rivers in the country. Alumina supply was already tight and prices have now surged to their highest level since 2010 in response to the shortage of raw materials. China has also been squeezing raw material supplies as part of its anti-pollution drive, limiting production of carbon anodes. Rusal’s own production of alumina is being disrupted as suppliers of bauxite to its alumina refineries declare force majeure in response to the US sanctions, tightening the market further.

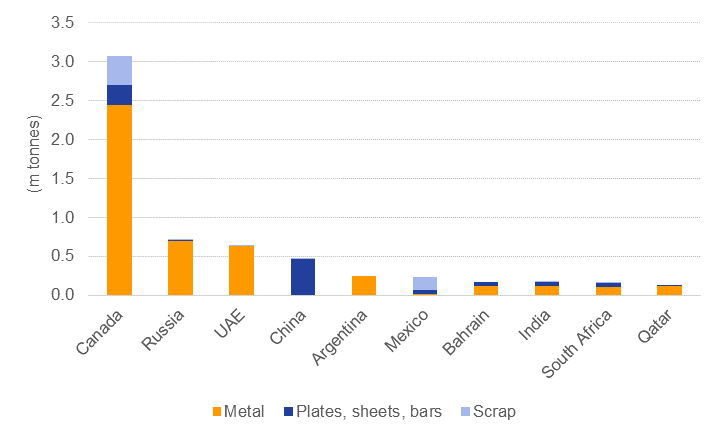

We expect that Rusal will continue to produce metal but that it will likely end up in new markets for the company and likely at a discount. China appears to be where the market is counting on the Russian metal turning up despite the domestic market being amply supplied. Could Chinese metal be exported to make way for Russian flows? Possibly but a like-for-like replacement of Chinese for Russian metal to US consumers for instance appears unlikely. Russian exports to the US were largely in the form of commodity metal while China mainly exported processed aluminium. Moreover, there appears to be little sign of movement from the US easing its tariffs on imports of aluminium, ostensibly designed to target China.

Source: USGS, Emirates NBD Research.

Source: USGS, Emirates NBD Research.

The sharp rise in primary aluminium prices reflects a market in the process of reorienting itself as a major producer is forced to the sideline. As a result we expect to see volatility remain heightened and aluminium prices well bid in the near term. We are consequently revising upward our forecast for 3mth aluminium to an average of around USD 2,200/tonne this year compared with closer to USD 2,000/tonne previously.