Since it began raising rates in March 2022, the Federal Open Market Committee has hiked the Fed Funds rate 10 times, with a total of 500bps worth of increases in just over a year. Although our current expectation is for a pause in hikes, minutes from the May FOMC meeting, together with recent comments from several non-voting Fed officials suggest that a June or July hike is still a possibility.

While the decision made by the FOMC at their next meeting will no doubt be based on a complex assessment of the most recent economic data, there is a quantitative approach, known as the Taylor rule, that may be employed to predict central bank policy decisions. This rule, developed by John Taylor in 1993, provides a simple mathematical basis for monetary policy decisions, and asserts that the policy rate is a function of a small set of economic variables, describing activity and inflation.

Not only have Taylor rules historically done a fair job of broadly tracking policy moves, comments by current and past FOMC members suggest that they also provide an important tool for policy makers, both as an input to FOMC discussions and as a communication tool to explain decisions.

The original Taylor rule hypothesized that the Federal Funds rate was a function of four components:

Taylor rule rate = Natural rate + Inflation + α*(Inflation - Target) + β*(Activity gap)

The first variable is the natural rate of interest, which is the level of short-term real interest rates which are consistent with an economy operating at full employment, while keeping inflation stable. The second is the prevailing inflation rate. The third factor is the gap between current inflation and the central bank’s target, while the fourth is some measure of the activity gap (a measure of the extent to which actual activity exceeds normal levels). Additionally, the third and fourth factors are weighted (α and β) to reflect the importance placed by the central bank on each of the gap measures.

As a tool to assess the likelihood and scale of possible further rate hikes, we estimate a set of 4 Taylor rules, varying a 2 of the key assumptions in the formula. In each of these alternatives we assume that the α and β weights applied to the Fed’s dual mandate of price and employment stability are 0.5 and 1, respectively. The activity gap is proxied using the negative of the unemployment gap, measured as the NAIRU (non-accelerating inflation rate of unemployment) less the current unemployment rate. Our set of Taylor rules also utilize PCE inflation, rather than headline or core inflation.

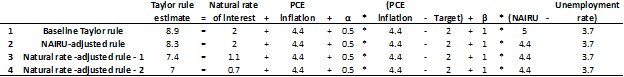

The table below provides an overview of the Fed Funds rate predicted by each of the four Taylor rule equations.

The first equation, referred to as the “Baseline Taylor rule”, is consistent with assumptions commonly used in the Taylor rule, including some of the defaults set in Bloomberg. In this version of the rule a value of 2% is used for the natural rate of interest, which is also consistent with the original specification as set out by Taylor in 1993. The value of the NAIRU is set at 5%. Combining these assumptions with current data on PCE inflation and the unemployment rate, suggests that the Fed Funds rate should be significantly higher than its current level of 5.25%, with a value of 8.9%.

It is however reasonable to assume that some of the assumptions used in the baseline version could be different. The first change we make to the standard baseline version is to reduce the size of the NAIRU assumption from 5% to 4.4%, consistent with the most recent Congressional Budget Office forecast. This change reduces the estimated value of the Fed funds rate to 8.3%. The second change we make is to assume that the natural rate of interest is in fact lower than the 2% default set by Bloomberg and Taylor in his original work. Several studies have suggested that the natural rate of interest has fallen significantly over the course of the past decade as a result of demographic factors and slowing productivity. The New York Fed publishes estimates of the natural rate, based on a variety of estimation techniques, pointing to values for the natural rate of between 1.1% and 0.7%. Our third and fourth equations therefore impose values of 1.1% and 0.7% respectively for the natural rate of interest. These again reduce the Taylor rule estimate for the Fed funds rate to 7.4% and 7.0%, in turn. Although these final estimates are significantly lower than the initial baseline estimate of 8.9%, they are still well above today’s Fed funds rate of 5.25% and would imply that the FOMC was likely to raise rates materially.

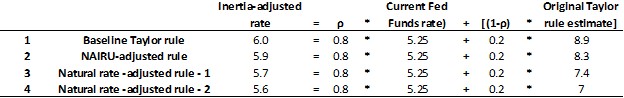

However, more recent work on the Taylor rule has also considered that central banks act with inertia, meaning that instead of responding by the full amount implied by the Taylor rule, they make slower smaller moves over time. Policy inertia was recently described by James Bullard, President of the Federal Reserve Bank of St. Louis, as a judgement made by the FOMC regarding the possible risks of the pace of adjustment, set against the benefits of achieving the inflation target as quickly as possible. We estimate inertia-adjusted Taylor rule policy rates for each of the four Taylor rules discussed above, using the following specification:

Inertia adjusted policy rate = ρ*Current Fed Funds rate + (1-ρ)* Initial Taylor rule rate

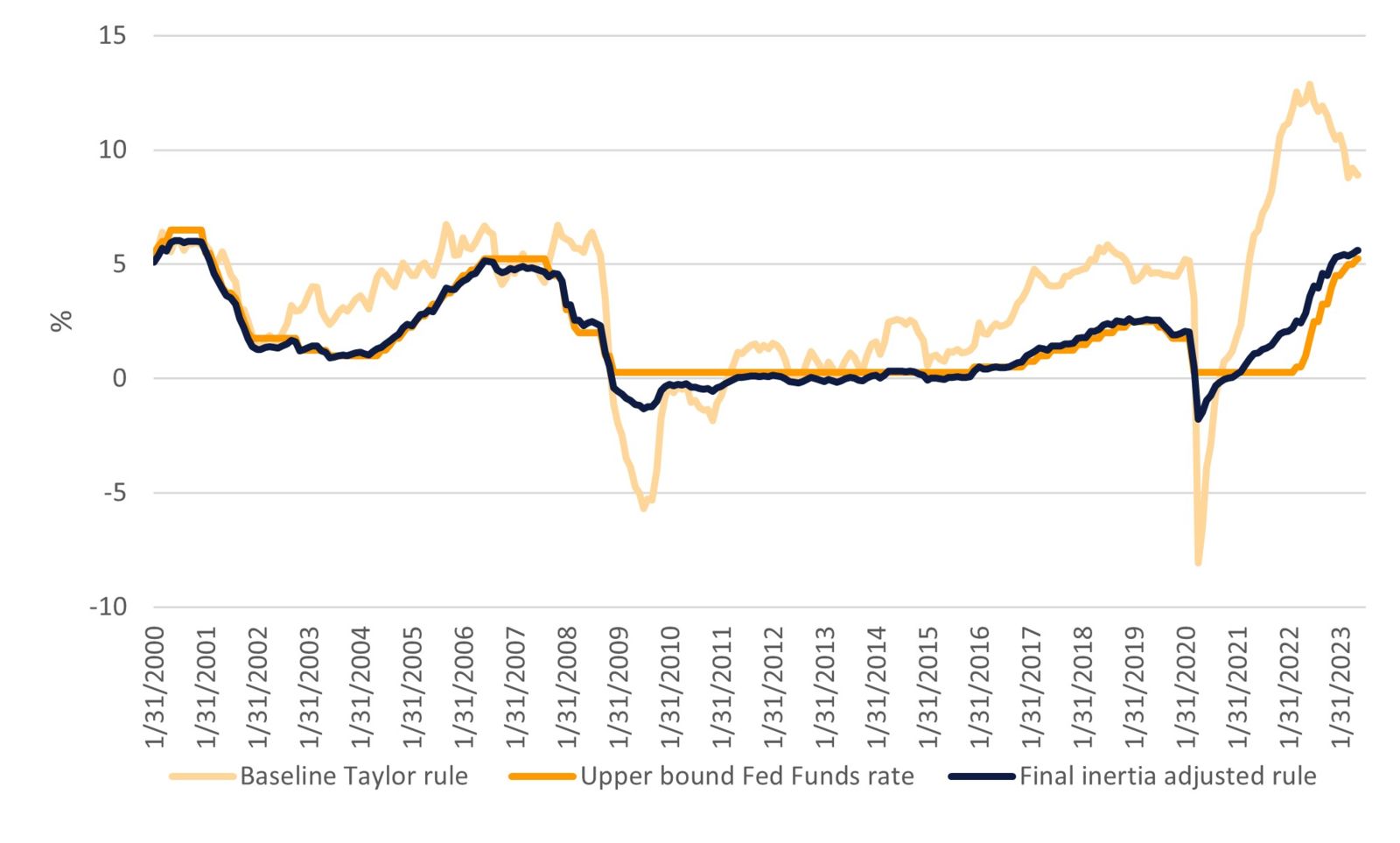

Consistent with the recent academic literature we assume a value of 0.8 for ρ. When we account for this central bank inertia, not only does the rate implied by the Taylor rule do a better job of matching the historical value of the actual Fed Funds rate, but it also significantly reduces the current value of the Fed Funds rate implied by the baseline Taylor rule.

The final inertia-adjusted rule has a value of 5.6%, which is materially closer to the current value of the upper-bound of the Fed Funds rate (5.25%) and the market implied value of 5.4% by July. The inertia-adjusted rules therefore imply that there is significantly less upside risk to the policy rate than the baseline Taylor rule might suggest.

Although our expectation is for a pause in rate hikes at the June meeting, if core inflation remains sticky and labour market indicators remain robust, there may be scope for another 25bp hike in July.