International Company for Water & Power Projects (“ACWA Power”), a private developer and operator of power and desalination plants in the Middle East, raised $814 million in May 2017 via issuance of senior secured, amortising bonds at 5.95% p.a., maturing in 2039 through its 100% owned SPV vehicle called ACWA Power Management and Investments One Ltd (APMI1).

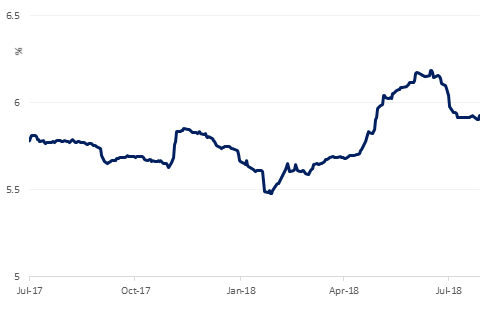

The issue, INTLWT 5.95% 12/15/2039, is rated BBB-/stable by S&P and Baa3/stable by Moody’s. Since being issued at par, INTLWT 39s have traded in the range of $97 to $106 and its yield has fluctuated between 5.48% and 6.18%. Despite the 72bps increase in the benchmark 10 year UST yields since mid-last year, the current yield on INTLWT 39s is 5.93%, tighter than the 5.95% at the time of issue which in turn is a validation of the company’s reliable credit profile.

Reflecting material outperformance, year-to-date total return on INTLWT 39s stands at over 3.9% compared with loss of around 2% on EM USD bond index.

ACWA Power owns circa 40 projects in 10 countries and also owns First National Operations & Management Company (NOMAC), an established manager and operator of power and water projects. INTLWT 39s will be serviced by cashflow received as payouts in the form of dividends, shareholder loan repayments and fees from eight of ACWA Power’s projects, all of which are located in Saudi Arabia and held via its subsidiary Arabian Company for Water and Power Projects (APP). In addition, cash flow from NOMAC’s certain Saudi Arabian projects will also contribute to INTWT 39s debt serving.

The bond structure is complex and is the first of this kind in the GCC region. However, strong underlying contractual arrangements with mostly government owned off-takers coupled with ACWA Power’s strategic importance in the Kingdom of Saudi Arabia, along with sizeable indirect support from the government has made these bonds attractive to investors.