Abu Dhabi raised USD 5bn in three tranche issues overnight as the emirate took advantage of the low interest rate environment and investor appetite for high grade credit to lock in long-term funding. The three year portion—USD 2bn worth—priced at 65bps over USTs, the 10yr at 105bps (raising USD 1.5bn) while the 50yr issue, the longest ever tenor for a Gulf borrower, priced at 2.7% and raised USD 1.5bn. We expect the UAE to run a consolidated budget deficit of -7% of GDP (approximately -USD 25bn) this year on lower oil revenue and increased spending. The emirate had raised USD 10bn in debt earlier this year.

German Q2 GDP was revised slightly higher to -9.7% q/q (-11.3% y/y) from -10.1% q/q (-11.7% y/y) in the second reading. However, this is still a record contraction for the German economy. Household consumption, exports and investment in machinery and equipment all declined sharply in Q2 but government consumption rose slightly, likely reflecting coronavirus related spending. The IFO business climate index came in slightly better than forecast at 92.6 for August, up from 90.4 in July. Both the current situation and expectations components improved from July, but the overall index remains below pre-pandemic levels and the rate of recovery has slowed. Separately, the German government decided yesterday to extend the job-subsidy program to end-2021 to prevent companies from rushing to make employees redundant. 5.6mn people received the benefit in July, according to Bloomberg.

US consumer confidence declined in August, with the Conference Board index falling to 84.8 from 91.7 in July and well below the expected reading of 93.0. Both the present situation and expectations component were weaker in August, possibly reflecting the expiration of the USD 600/ week federal unemployment benefit at the end of July, and congress’ failure to pass a new stimulus passage so far. However, new home sales in July beat expectations rising 13.9% m/m to 901k, underlining the strength of the housing market despite the pandemic.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Benchmark bond markets were lower overnight as risk assets continued to rally amid vaccine news and expectations that the Federal Reserve will lay out policies that should keep policy rates low for the long run later this week. The curve bear steepened with yields on 2yr USTs holding roughly flat at 0.1493%. Yields on 10yr USTs added almost 2bps to 0.6835. The 2s10s spread closed higher by over 3bps.

Bond markets in Europe also edged lower with the gain in yield much stronger than in the US. Bund yields closed almost 6bps higher at -0.435% while both French and UK bond yields added more than 5bps.

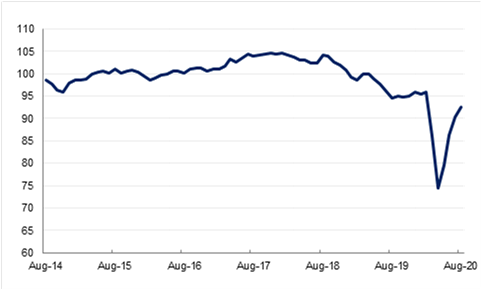

The dollar remained on the defensive on Tuesday despite some progress in US-China trade talks. The DXY index recorded minor losses and currently trades at 93.110. New home sales in the US rose much more than expected but consumer confidence was down. Broad-based dollar weakness did not stop USDJPY from advancing by 0.45% to 106.45. The 50-day moving average of 106.58 will be the next key indicator for the pairing.

The euro regained its position above the 1.18 handle, recording modest gains to trade at 1.1820 whilst sterling rallied by over 0.55% to reach 1.3135. Similarly the AUD and NZD advanced to 0.7190 and 0.6550 respectively.

Risk-on sentiment in the US continued yesterday, as hopes for effective Covid-19 treatment and easing US-China tensions helped to push the S&P 500 up to a new record high for the third day in a row, with the index gaining 0.4% yesterday. The NASDAQ also hit a new record on a 0.8% gain, but the Dow slipped slightly, losing 0.2%. However, European equities were not quite so bullish, and while the CAC and DAX closed broadly flat (up 0.1% and down 0.4% respectively), the FTSE 100 lost 1.1% as economic data from the CBI showed that the retail sector was shedding jobs at the fastest pace since 2009.

In the region, the DFM gained 1.0%, while the Tadawul closed down 0.2%.

Oil prices were buoyed by the expected landfall of Hurricane Laura along the US Gulf Coast, which has already sparked a boost in gasoline prices as refining capacity is closed. Brent futures added more than 1.6% to settle at USD 45.86/b and are closing in on a sustained push above USD 46/b. WTI futures added 1.7% to close at USD 43.45/b.

The API reported bullish inventory numbers overnight, estimating that US crude stocks fell by 4.5m bbl last week along with a 6.4m bbl drop in gasoline stocks. EIA data will be released later today.