Early results indicate that incumbent President Abdel Fattah el-Sisi has won a second term in Egyptian presidential elections last week, garnering as much as 92% of the vote. His sole opponent, Moussa Moustapha Moussa, received 3%, while the remainder of the voters spoiled their papers. A victory for President Sisi was never in much doubt, but the authorities may be disappointed with turnout which reportedly dipped to around 40%, from 47% in 2014, despite incentives and threats of charges for those who did not cast their ballot.

We expect that a second term for Sisi will mean a continuation of the IMF-sponsored economic reform programme which has been in action since November 2016. Much has been done already, most significantly the removal of the Egyptian pound’s peg to the US dollar, the subsequent sharp depreciation of which made the country more competitive but also hit ordinary Egyptians hard as inflation spiralled. Further reforms expected this year include the privatisation of a number of state-owned entities and the removal of further subsidies at the start of the new fiscal year in July. If the lower-than-hoped for voter turnout is perceived as being a sign of waning support for reform, there is a chance that the subsidy cuts could be staggered so as to ease the pressure on Egyptian citizens. Nevertheless, the general reform programme will continue apace, and we expect further rebalancing of the economy. The vote passed peacefully, and ongoing political stability will also be positive for investment.

Monetary easing continues

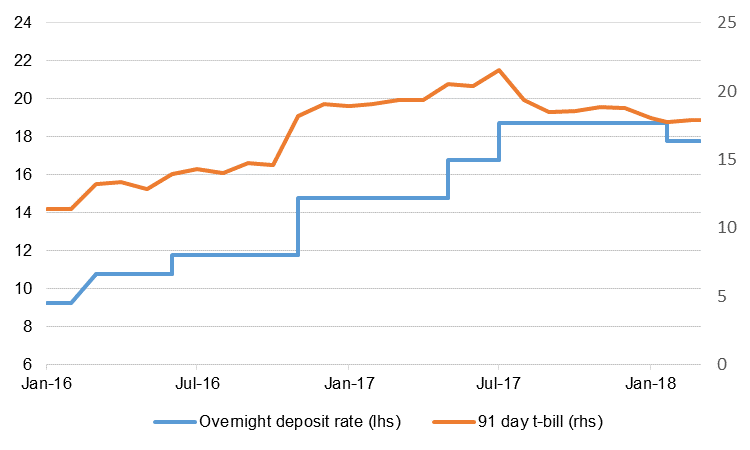

As was widely expected, the Central Bank of Egypt (CBE) cut its key policy rates by 100 bps on March 29, taking the overnight lending rate to 17.75% and the overnight deposit rate to 16.75%. This follows an initial 100bps cut made in mid-February. As inflation soared following the currency peg removal in late 2016, hitting 33.0% at its peak in July last year, the CBE enacted a cumulative 700 bps of hikes in order to curb expectations. With the deprecation now in the base, price growth has fallen markedly, to just 14.4% in February, which has enabled the bank to start normalising monetary policy.

We anticipate a further 200bps of cuts over the remainder of the year, likely in the second half after a hiatus over the next several meetings. While inflationary pressures have eased significantly, the potential size of subsidy cuts due in July will keep price growth from continuing to fall at this pace - the CBE’s communiqué said that it will be watching the ‘timing and magnitude of potential subsidy-reform measures’ closely. Higher oil prices were also cited by the bank as a potential source of inflationary pressure. Further, the IMF is supportive of high interest rates in Egypt, and the bank will be wary of prompting capital flight of the significant portfolio investment that has flooded into Egypt over the past 18 months, especially in light of global monetary tightening.